Search This Supplers Products:China PVDF manufacturerChina FKM manufacturerPVDFFluoropolymer manufacturerHigh quality PVDFFKM

Demand for PVDF in the next 5 years

time2023/11/13

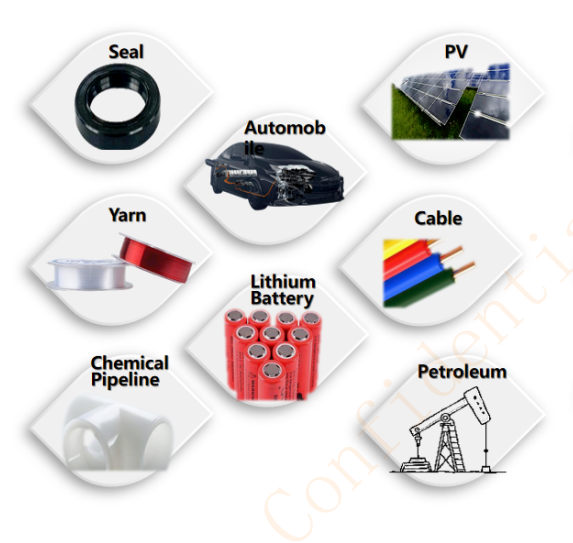

- Since 2023, the rapid development of consumer electronics, new energy vehicles, photovoltaic energy storage and other industries has allowed the PVDF market demand to continue to rise. Among them, the new energy automobile market is the backbone to ensure the sustainable development of the PVDF industry.

In terms of auto consumer market statistics in June, the new energy vehicle market retailed 665,000 units, up 25.2% year-on-year. 2023 January-June, the market cumulative retail new energy vehicles 3,086,000 units, up 37.3% year-on-year. The expansion of the new energy vehicle market scale will inevitably require the support of the battery market. According to the data of China Automotive Power Battery Industry Innovation Alliance, from January to May 2023, China's cumulative power battery loading was 119.2GWh, an increase of 43.5% year-on-year. It is expected that by 2025 the global demand for lithium grade PVDF will exceed 120,000 tonnes. It can be foreseen that with the growing market demand for downstream lithium batteries and other markets, the market application of PVDF will have a broader outlook.

From the market supply and demand point of view, in 2022-2025, China's total PVDF production capacity is expected to rise from 135,000 tonnes to 239,000 tonnes, compared with 69,000 tonnes in 2020, the production capacity to achieve a doubling of the capacity, but this is still unable to meet the demand of the existing stock market and future incremental market. Because the downstream demand is also on a fast-growing track, especially the two major markets of photovoltaic and lithium battery, which will become the core application market of PVDF in the future. According to the China Photovoltaic Industry Association forecast, it is expected that by 2025, the global PV new installed capacity will reach 330GWh, which is 2.4 times of 2020. According to GGII (GGII Lithium Institute) data, it is expected that by 2025, China's lithium battery market shipments will exceed 610GWh, with a compound annual growth rate of about 34%. By the "photovoltaic + lithium" two new energy track support, PVDF industry by the industry and the investment community is optimistic.

From the industrial layout and investment point of view, the development of the PVDF industry is highly dependent on the raw material market. Especially as the market enters the high boom era, mastering the right to supply raw materials, especially with R142b raw materials supporting the supply of enterprises, will inevitably rely on raw material advantages and scale advantages to steadily increase market share. From the policy level, the current R142b raw material market is still the implementation of the quota system, combined with the second generation of refrigerant reduction plan in developing countries, is expected to 2025, R142b raw material supply will be cut by 67.5%, which will have a greater impact on the supply of PVDF industry. It can be predicted that with the raw material supply contraction, the future supply of PVDF industry will still be tightened, and the price of related products will continue to rise. Enterprises that do a good job of supply chain layout in advance and have a mature industrial chain and market will have a strong advantage in the future competition in the PVDF market.